pa local services tax deductible

In tracking it down I found that my deductions for state and local taxes are off. It is due quarterly on a prorated basis determined by the.

State And Local Tax Salt Deduction Salt Deduction Taxedu

8 rows Deductions Allowed For Pennsylvania Tax Purposes.

. In tracking it down I found that my deductions for state and local taxes are off. Pennsylvania Department of Revenue Im looking for. Pennsylvania allows four deductions.

Thus it is not a deductible local income tax. Local Income Tax Information Local Withholding Tax FAQs. To connect with the Governors Center.

DCED Local Government Services Act 32. The PA Local Services Tax is an employment related tax not based upon income amount. The PA Local Services Tax is an employment related tax not based upon income amount.

If your municipality charges a local services tax LST you may be wondering if the amount from. June 7 2019 525 PM. In the past it could be deducted as a.

Set up the PA local services tax. However as a result of the 2017 tax reforms one cannot. Local and Federal Tax Info Begin Main Content Area Page Content.

In the past it could be deducted. The name of the tax is changed to the Local Services Tax LST. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

The PA Local Services Tax is an employment related tax not based upon income amount. Formerly the Emergency and Municipal Services Tax Pennsylvania Act 7 of 2007 amends the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the. For more info on the Pennsylvania Local Services Tax see Local Services Tax LST.

As a result it is not a deductible local income tax. This is listed on my W2 in box 14 as PA LST. In the past it could be deducted as a.

This is the date when the taxpayer is liable for the new tax rate. Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that. However with the 2017.

Thus it is not a deductible local income tax. Thus it is not a deductible local income tax. I tracked down the difference to my local services tax LST.

In the past it could be deducted as a. Thus it is not a deductible local income tax. Thus it is not a deductible local income tax.

All employers located within Middletown Township must withhold the Local Services Tax at the annual rate of 52 for all employees with annual gross income from wages in excess of. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST. The PA Local Services Tax is a tax on employment that is not based on income.

Local Income Tax Requirements for Employers. The PA Local Services Tax is an employment related tax not based upon income amount. If your municipality charges a local services tax LST you may be wondering if the amount from your W-2 box 14 LST category can be deducted on your federal income.

Go to Payroll then Employees. Local Withholding Tax FAQs. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and.

The PA Local Services Tax is an employment related tax not based upon income amount.

State And Local Taxes What Is The Salt Deduction

How Do I Find The Pa Local Tax Codes To Set Up For Employees

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Pennsylvania Property Tax H R Block

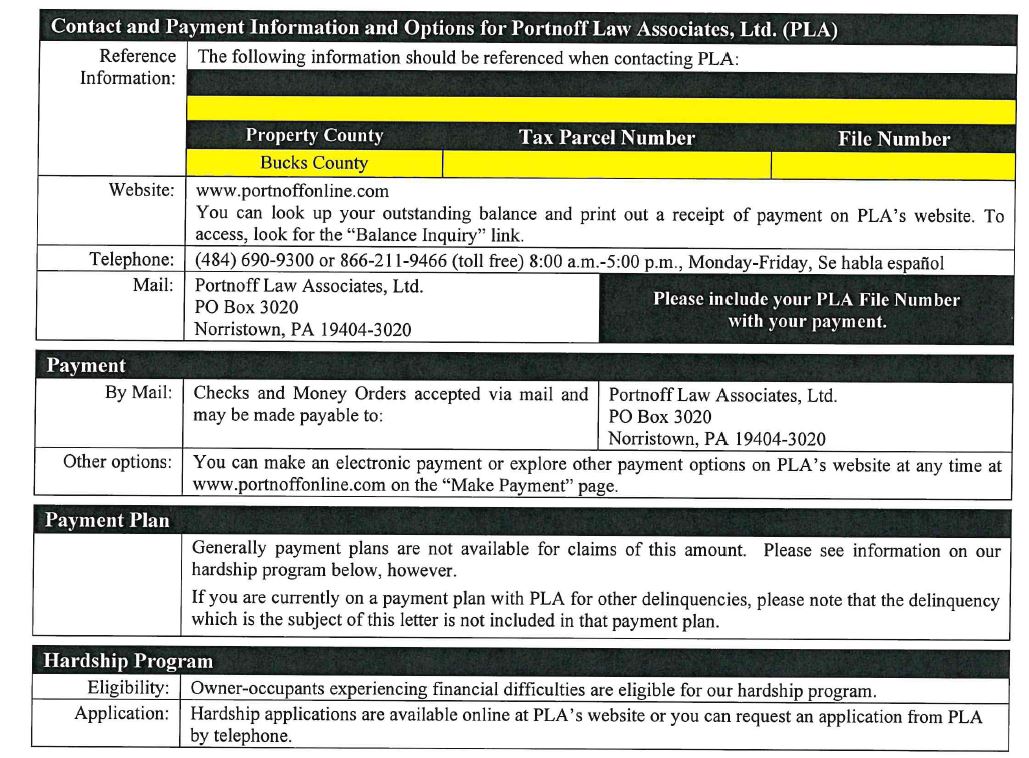

Tax Collection Warminster Township

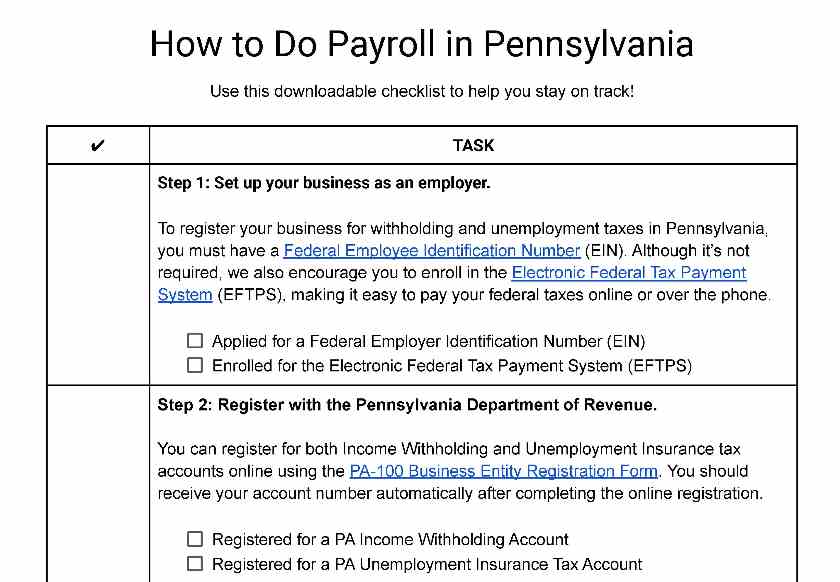

How To Do Payroll In Pennsylvania What Every Employer Needs To Know

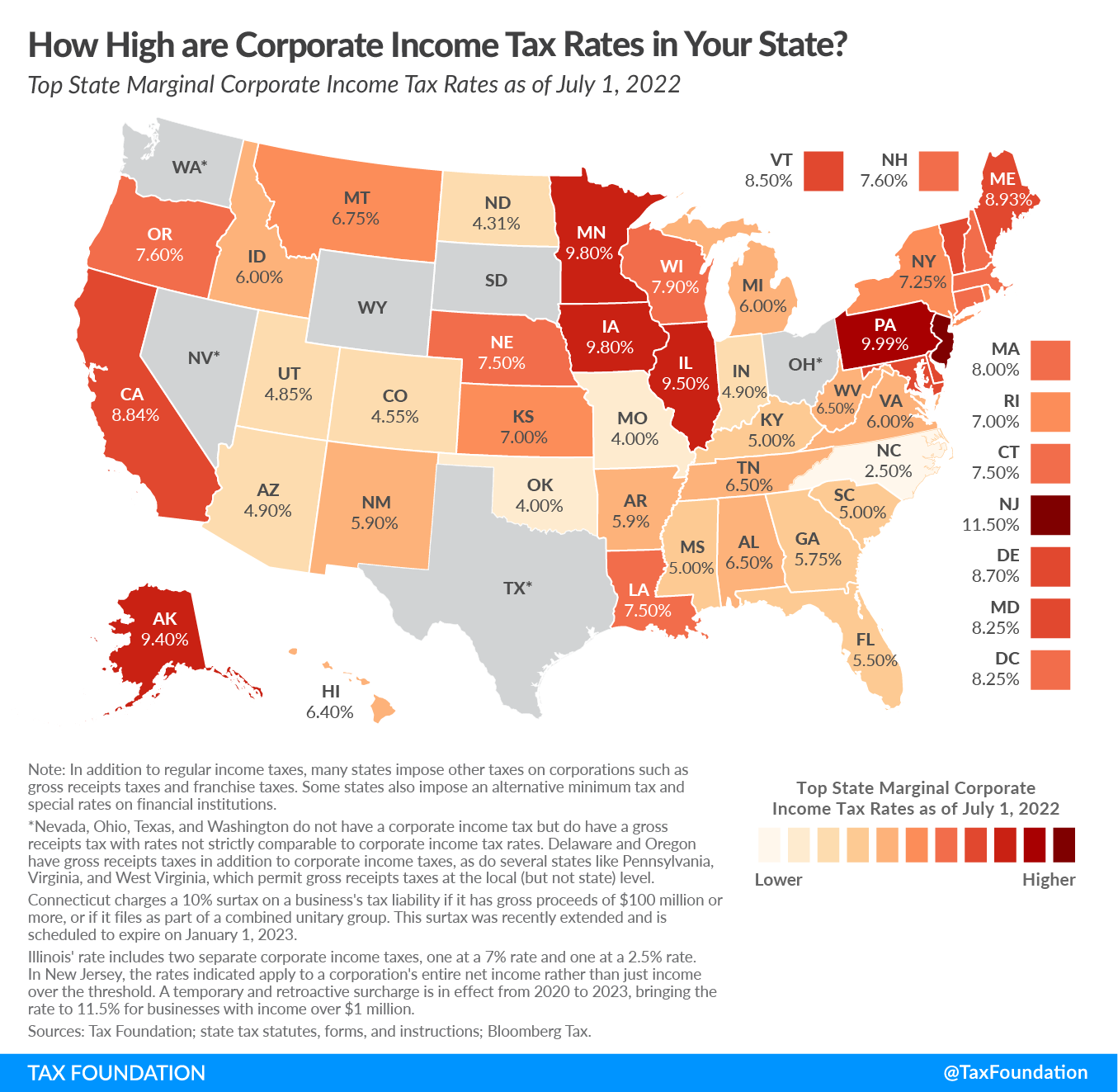

Pa Corporate Tax Cut Details Analysis Tax Foundation

Earned Income Tax Middletown Township Bucks County Pa

Solved In Box 14 On My Wife S 2015 W 2 What Does Lst And Pa Sui Mean

12242 Pa Splitting Tax Between School District And Municipality

Retirement Tax Planning Pennsylvania V Delaware Kendal Crosslands Communities

Local Services Tax Springfield Township

Unemployment Benefits Tax Issues Uchelp Org

Upper Darby Pennsylvania Tax Office

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Salt Cap Repeal Salt Deduction And Who Benefits From It

York Adams Tax Bureau Pennsylvania Municipal Taxes

Eitc News And Spe Information Central Pennsylvania Scholarship Fund