south dakota sales tax rate 2021

Click here for a larger sales tax map or here for a sales tax table. What is South Dakotas Sales Tax Rate.

South Dakota Sales Tax Rates By City County 2022

Has impacted many state nexus laws and sales tax collection requirements.

. What Rates may Municipalities Impose. Has impacted many state nexus laws and sales tax collection requirements. Groceries and prescription drugs are exempt from the Colorado sales tax.

Taxpayer Bill of Rights. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. To review the.

Or to make things even easier input the Las Vegas minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need. Municipalities and other local government units. Wayfair that sellers can be required to collect sales taxes in states where the sellers do not.

The process of tracking individual state sales taxes that enforce economic nexus can be daunting time-consuming and expensive. South Dakota has recent rate changes Thu Jul 01 2021. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Cigarettes in South Dakota are taxed at a rate of 153 per pack of 20 slightly lower than the national mark. Save time and money with Wise Business. Wayfair Inc affect North Carolina.

Along with the sales tax rates described above some cities in the state levy an additional 1 tax on alcohol sales bringing the total rate up to 75 in many cities. South Dakotas tax system ranks 2nd overall on our 2022 State Business Tax Climate Index. South Dakota Cigarette Tax.

The state sales tax rate in South Dakota is 4500. On June 21 2018 South Dakota vWayfair Inc. TAX DAY NOW MAY 17th - There are -468 days left until taxes are due.

The 2018 United States Supreme Court decision in South Dakota v. To get the sales tax rate you need you must add together all applicable taxes in your location. State and Local Sales Tax Rates Midyear 2020.

This is the total of state county and city sales tax rates. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. The 2018 United States Supreme Court decision in South Dakota v.

South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and local sales tax rate of 640 percent. 2020 United States census. This law became effective on June 21 2018 when the United States Supreme Court ruled in South Dakota v.

This page will be updated monthly as new sales tax rates are released. To review the rules in Nevada visit our state-by-state guide. The Clark County sales tax rate is.

Overturned a 1992 Supreme Court ruling. Taxes are never simple but our handy sales tax lookup tool can help you find the correct minimum combined local and state sales tax rate for your area. Combined with the state sales tax the highest sales tax rate in South Carolina is 9 in the.

States can now require ecommerce businesses to pay sales taxes where those businesses have an economic presence or nexus. The minimum combined 2022 sales tax rate for Charlotte North Carolina is. Each states tax code is a.

Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations. Over the past year there have been 21 local sales tax rate changes in California. The state sales tax rate is 45 percent.

The South Dakota Special Tax Division regulates some taxes including cigarette and alcohol-related taxes. The Role of Competition in Setting Sales Tax Rate. Start filing your tax return now.

The sales taxes in Hawaii and South Dakota have bases that include many services and so are not strictly comparable to other sales taxes. The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax. Sales tax total amount of sale x sales tax rate in this case 838.

State and Local Sales Tax Rates 2021. Colorado has 560 special sales tax jurisdictions with local sales taxes in. With local taxes the total sales tax rate is between 4500 and 7500.

Automating sales tax compliance can help your business keep compliant with changing sales. South Dakota also does not have a corporate income tax. To calculate the amount of sales tax to charge in Las Vegas use this simple formula.

The easier way to connect with. South Carolina has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3There are a total of 118 local tax jurisdictions across the state collecting an average local tax of 1662. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

South Dakota Alcohol Tax. Select the South Dakota city from the list of popular cities below to. Businesses who would like to apply for reinstatement with the Secretary of States office must first receive a tax clearance certificate from the Department of Revenue.

Gross receipts tax is applied to sales of. The South Dakota sales tax and use tax rates are 45. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Sales Use Tax South Dakota Department Of Revenue

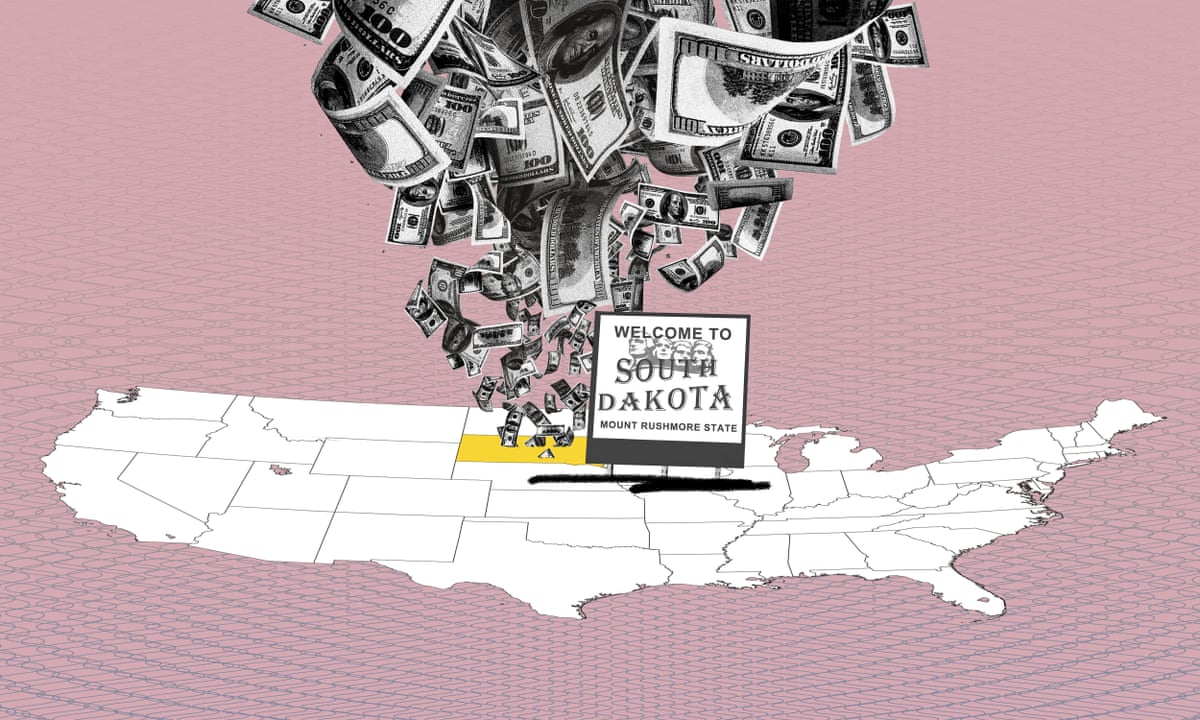

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Tax Rates To Celebrate Gulfshore Business

South Dakota State Economic Profile Rich States Poor States

Sales Tax By State Is Saas Taxable Taxjar

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

States Without Sales Tax Article

The Most And Least Tax Friendly Us States

State Corporate Income Tax Rates And Brackets Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

How To Register For A Sales Tax Permit Taxjar

Sales Use Tax South Dakota Department Of Revenue

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)